Cryptocurrency Trading Bots: Pros and Cons You Should Know! 🚀🤖

Discover the pros and cons of cryptocurrency trading bots! These attractive tools automate trading, maximize profits, and come with risks to consider when trading in the cryptocurrency world. 🚀💰

Summary of the Advantages and Disadvantages of Cryptocurrency Trading Bots

The cryptocurrency trading bots han revolucionado la forma en que los inversores interactúan con los mercados. Estas herramientas automáticas brindan comodidad, velocidad y eficiencia al ejecutar operaciones, pero no están exentas de riesgos. Comprender las ventajas y desventajas de los bots ayuda a los traders a tomar decisiones informadas sobre sus inversiones. 🤖💼

Main Advantages of Cryptocurrency Trading Bots

- 24/7 Market Monitoring: Bots operate continuously, taking advantage of trading opportunities all day long. 🌍

- Eliminating Emotional Trading: Automation reduces the risks of impulsive, emotionally driven decisions. 🧠

- Speed and Efficiency: They execute operations faster than manual methods, minimizing delays and missed opportunities.

- Strategy Tests: Bots can simulate strategies using historical data to improve their performance. 📊

- Customizable Algorithms: Traders can customize bots to suit specific strategies or goals. 🎯

Main Disadvantages of Cryptocurrency Trading Bots

- Market Volatility Risks: Bots can execute trades in highly volatile markets, which could result in losses. 📉

- Complex Configuration: They require technical knowledge for proper setup and maintenance. 🔧

- Expensive Services: High-quality bots or platforms often come with hefty fees or subscriptions. 💸

- No Guaranteed Success: Bots are only as effective as the strategies they're programmed to follow. ⚖️

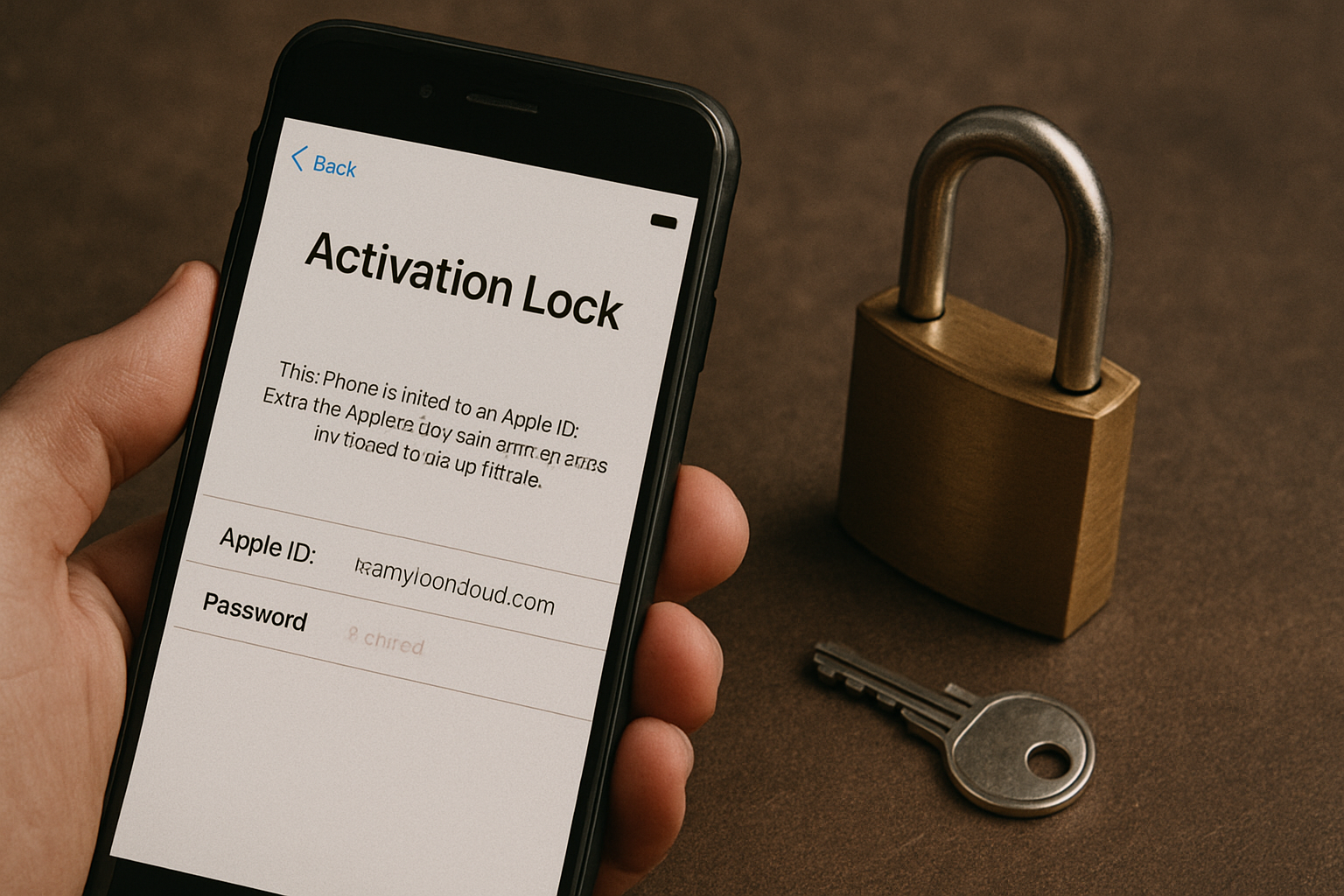

- Safety Concerns: Risk of account breaches when using third-party platforms or APIs. 🔒

The cryptocurrency market is growing in complexity and speed, leading investors to turn to cryptocurrency services for trading bots To maximize your profits and optimize capture opportunities. Cryptocurrency trading bots allow users to automate their trades and execute complex strategies with minimal manual intervention. Let's talk about the benefits and risks of trading using bots. 🌟

Here is a table detailing the advantages and disadvantages of cryptocurrency trading bots:

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Automation | Execute trades automatically, saving time and reducing emotional trading. | Over-reliance on automation can lead to losses if bots fail or experience connectivity issues. |

| Trading 24/7 | It operates continuously, capturing opportunities even when the trader is offline. | You may execute trades in very volatile markets, which could cause potential losses. |

| Speed | Processes operations faster than humans, taking advantage of short-term opportunities. | Overly frequent transactions can incur high transaction fees and reduce profitability. |

| Retroactive Testing | Test strategies on historical data to optimize trading performance. | Success in backtesting does not guarantee real-world effectiveness. |

| Trading Without Emotions | It eliminates human emotions such as fear or greed, ensuring disciplined trading. | You can't adapt to sudden changes in market sentiment or unforeseen events without the right algorithms. |

| Personalization | It can be programmed to follow specific trading strategies and preferences. | It requires technical expertise to configure and adjust it correctly. |

| Monitoring Efficiency | Track multiple cryptocurrencies simultaneously, maximizing trading opportunities. | Reliance on bots can lead to traders failing to stay up-to-date on market trends. |

| Cost | Reduce time spent on manual trading, potentially saving costs in the long run. | High-quality bots can be expensive, with ongoing subscription or maintenance fees. |

| Market Adaptability | They can quickly adapt to predefined market conditions. | Predefined conditions may fail in unforeseen market scenarios, causing losses. |

How Do Automated Trading Bots Work?

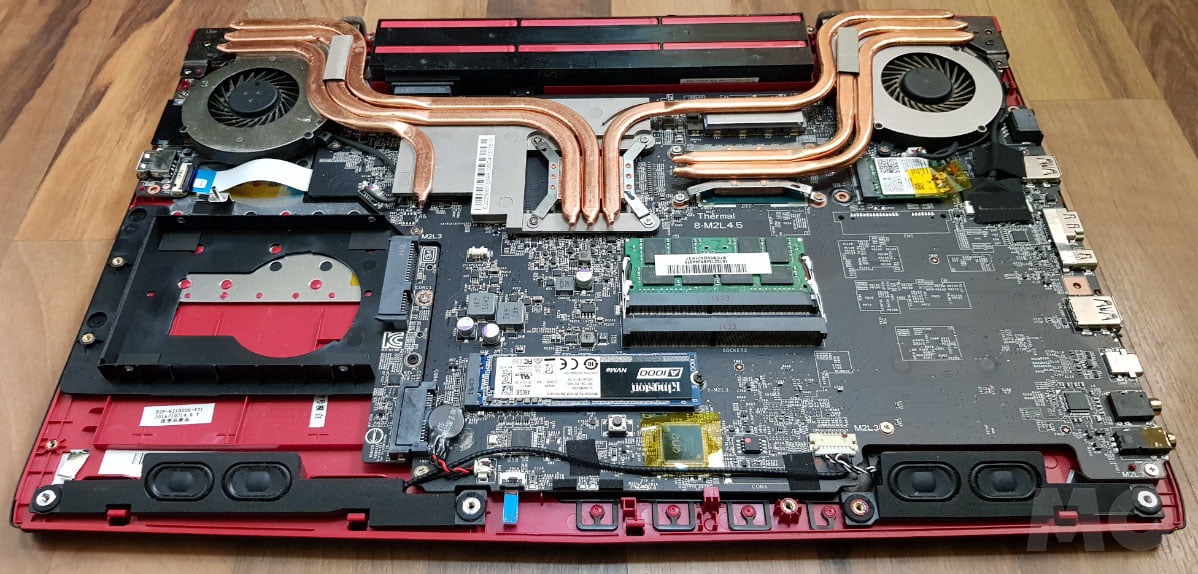

Cryptocurrency trading bots work by interacting with exchanges through API integration, allowing users to set predefined conditions for trade execution. These bots typically utilize algorithmic trading techniques, combining various strategies, such as trend following, arbitrage, and market making, to make decisions based on real-time data.

The process begins with market analysis and price monitoring, which involves gathering and interpreting historical and live data to identify potential opportunities. Users can often choose from different types of bots, including rule-based and AI-driven models, depending on the complexity of their trading needs. Once the analysis is complete, trading bots act on these insights, executing buy or sell orders according to programmed strategies. Advanced bots can also backtest strategies using historical data to refine their algorithms, helping traders optimize strategies before implementing them in live markets. 🧪📈

Benefits of Trading Bots

Here are the advantages of using a bot:

- Continuous operation. Trading bots operate 24/7, executing trades even when users are offline or asleep, which is crucial in a market that never closes. 🌙

- Efficient price tracking. Bots continuously monitor asset price fluctuations, responding more quickly to market changes than manual trading, which can be beneficial in the volatile cryptocurrency market. 📉

- Real-time trading execution. Bots react instantly to market signals, ensuring rapid execution that minimizes latency in fast-paced markets. ⏱️

- Emotionless trading. Human emotions, such as fear and greed, can undermine trading decisions. Bots strictly follow programmed parameters, eliminating the influence of emotions and helping to maximize profits. 😊

- Customizable trading strategies. Different types of bots work with diverse trading strategies, from arbitrage and scalping to market making. Users can customize their bots to match their specific goals and risk tolerance. 🎨

Risks of Using Cryptocurrency Trading Bots

While trading bots offer several advantages, users should be aware of the Risks of cryptocurrency trading botsPoorly programmed or inadequately tested bots can lead to significant losses, especially in the volatile cryptocurrency market. Below are the main risks to consider:

1. Poor Programming and Testing

Cryptocurrency trading bots require precise programming and rigorous testing. Bots that lack proper development can make costly mistakes, especially in unpredictable markets. Learn more about Common programming errors in trading bots to avoid setbacks. ⚠️

2. Security Risks with API Integration

Using APIs to connect bots to exchanges exposes them to security vulnerabilities. Poorly secured bots are at risk of hacker attacks, potentially compromising user funds. I discovered Ways to secure cryptocurrency trading bots to protect your assets. 🔐

3. Impact of Market Volatility

Cryptocurrency markets are known for their sudden and unexpected price movements. These fluctuations can disrupt a bot's logic, resulting in unanticipated losses. 📉

4. Over-optimization

Some traders over-refine their bots to perform well in past scenarios, resulting in strategies that can fail in live markets. This approach can reduce a bot's effectiveness in dynamic environments. Avoid over-optimization by following these steps: These guidelines. ⚙️

5. Technical Problems

Inaccurate data streams, slow algorithms, or connection issues can hinder a bot's performance, potentially causing losses. Make sure you're using reliable infrastructure by consulting This resource. 🔗

Traders should approach cryptocurrency trading bots with caution, ensuring a clear understanding of their functionality, benefits, and limitations. With proper consideration and configuration, trading bots can be a valuable component of a trading strategy. 🏆