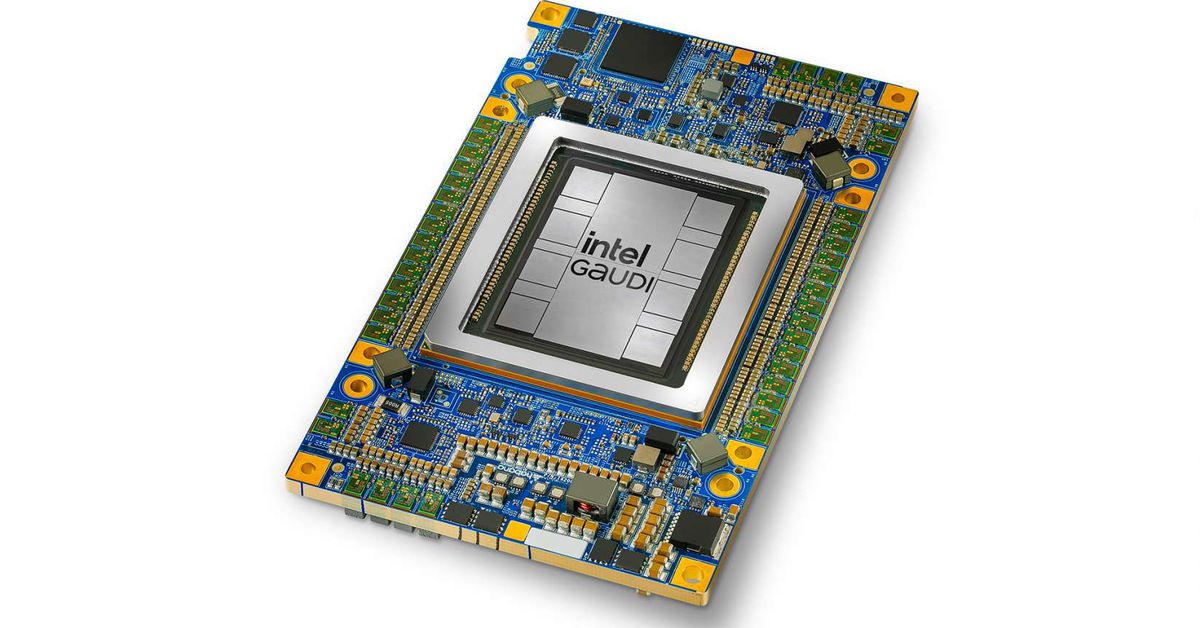

Intel's Gaudi AI chips are far behind Nvidia and AMD and will miss their $5 billion target.

“We will not achieve our 2024 revenue target of $1.5 billion,” CEO Pat Gelsinger said on the company’s third-quarter 2024 earnings call today.

Although Intel launched its recent Gaudi 3 accelerator last quarter, Gelsinger commented, “overall adoption of Gaudi has been slower than we expected as adoption rates were impacted by the product transition from Gaudi 2 to Gaudi 3 and the ease of use of the software.”

Despite falling short of the target, Gelsinger says, “We are encouraged by the market available to us. There is a clear need for solutions with a higher [total cost of ownership] based on open standards, and we are continuing to improve the Gaudi value proposition.”

Later in the call, Gelsinger appeared to have some criticisms to share, noting that so far, the massive spending of the AI chip industry has focused on model training of AI in the cloud. “Training is creating the climate model, not using it,” he says, suggesting once again that incorporating AI into all chips, not just those in the cloud, could be more important in the long run.

Intel reported $13.3 billion in revenue in its quarterly earnings today, down 6 percent year-over-year but up from last quarter, with losses of a whopping $16.6 billion. However, these losses were underpinned by $18.5 billion of impairments and restructuring charges, the cost of Intel’s decision to reinvent itself for greater profitability in the future.

Last quarter, it announced a $10 billion cost-cutting plan and more than 15,000 layoffs, and now it's also detailing some of the structural changes within the company, including moving its cloud computing business into the Client Computing Group, which typically handles its desktop and laptop chips, and integrating its cloud computing teams into its Client Computing Group. software in the company's core business units.

Gelsinger says Intel will “focus on fewer projects, with the top priority being maximizing the value of our x86 franchise in the client, cloud and data center markets.”

In conclusion, Intel faces significant challenges in the competitive AI chip market, with its Gaudi products lagging behind leaders such as Nvidia and AMD.

Despite not meeting its target of $1.4 billion in revenue by 2024, the company continues to identify opportunities in the market for cloud-based solutions. open standards.

CEO Pat Gelsinger acknowledges the slow adoption of Gaudi chips and the complexity of transitioning between generations of products as contributing factors.

Intel CEO Pat Gelsinger tells @EdLudlow the company plans to continue investing in their AI platform “Gaudi,” despite it missing its sales target this year https://t.co/JO6LKAqmJ9 pic.twitter.com/WxsjRkXGXx

— Bloomberg Technology (@technology) October 31, 2024

However, he sees potential in the broad application of AI beyond cloud training, suggesting a more inclusive approach in the future.

In financial terms, Intel reported a year-over-year decline in revenue, but is also making strategic moves to restructure and become more profitable in the long term.

This includes significant cost cuts and internal reorganization to maximize the value of its x86 franchise in key markets.

As Intel moves forward, the company appears to be committed to a more focused and adaptable strategy to meet the challenges of the sector. technologicalThis renewed tactic is reflected in its ability to innovate and evolve in a constantly changing and highly competitive market. Intel works hard to keep at the forefront by implementing cutting-edge technologies and developing customized solutions that meet the growing demands of the industry.